The EU emissions trading system shows its muscles

In her speech at US President Joe Biden's climate summit, Vattenfall's CEO Anna Borg called the price of CO2 emissions the single most effective tool for achieving climate targets. Here is the reason:

The European Union has set before itself the ambitious objective of becoming climate-neutral by 2050, meaning that the goal is to achieve ‘net-zero’ greenhouse gas (GHG) emissions, as our region’s contribution to reaching the Paris Agreement’s goal of limiting global warming to 1.5 °C.

In order to strike the right path towards this mid-century goal, the EU and its Member States agreed in April to decrease the emissions by at least 55 percent by 2030 compared to 1990. This commitment has recently been inscribed in the first ever European Climate Law.

Emissions price above 50 euro

A key instrument for reaching the EU’s new climate targets is the EU Emissions Trading System (EU ETS). This market-based instrument puts an absolute and declining cap on the total CO2 emissions from the sectors it regulates (power and district heating, energy-intensive industries, and intra-EU aviation), while incentivising cost-effective CO2 emissions reductions based on the EU-wide and uniform CO2 price that is determined by the market. Today, around 45 per cent of the EU’s total GHG emissions are regulated by the EU ETS directive.

"The EU emissions trading system is today in much better shape than a few years ago," says Erik Filipsson, Policy Advisor at Vattenfall Public & Regulatory Affairs EU, and points at the fact that in the first week of May, the ETS market prices rose above 50 euro per tonne CO2 for the first time ever.

Coal gets switched out

The European Commission wants to achieve the EU’s climate objectives by making the polluter pay. Without a CO2 price, coal-fired power stations, for example, would be much cheaper than gas, but they are also twice as polluting.

"In the past, coal-fired power stations were always running, and we used to produce the remaining demand with gas-fired assets," explains Nanne Visser 't Hooft, Head of Cross Commodity at BU Trading in Hamburg. "But since the advent of the EU ETS, it's better to tap into other energy sources or looking for alternatives. Thanks to the EU ETS we have seen significant fuel-switching from coal to gas in the European power market in last few years”.

Tenfold increase in four years

The basic principle is simple: For every tonne of CO2 that is emitted, the operator must cancel CO2 allowances, and if too much CO2 is emitted in relation to the allowances, high fines must be paid.

Companies can also trade with their CO2 allowances, so-called EUAs. Trading takes place every day on the EEX and ICE futures exchanges. In 2017, the confidence for the EU ETS system was at its lowest point and CO2 prices were around EUR 5 per tonne. Because there were too many allowances in circulation, prices remained low, and this did not encourage companies to invest in sustainable production methods.

"Following the latest reform of the EU ETS that was agreed in 2017, the CO2 prices has risen sharply the past few years and are currently trading above 50 euros. High prices do have a flipside though. If prices continue to rise rapidly, some companies could run into problems because they can no longer afford the costs. Ideally, prices should rise slowly, so that companies have time to examine how they can make sustainable investments and how they can recoup them. It remains a balancing act," Nanne Visser 't Hooft says.

CO2 price surge: In four years’ time, the price on European emissions rights, EU ETS, has increased tenfold.

Industry moving slowly

Since 2017, a lot more confidence is induced in the emissions trading system and this has had real market effects especially in the energy sector: producing electricity from coal is no longer profitable because of the higher CO2 costs.

"When the EU policy makers strengthens the EU ETS policy, the market forces find the most cost-effective CO2 emissions abatement solutions to comply with the new allowance cap,” says Erik Filipsson. “In the energy sector, we have come relatively far in decarbonising the supply and adapting to the stricter climate policy, but in industry things are moving more slowly. This is due to e.g. fossil fuels being used as raw material, long investment cycles and higher abatement costs. But the awareness of where the ETS allowances cap is heading over the coming decades makes also the industry prepare for a more CO2-constraint future. Therefore, we see some very exciting plans and initiatives to fundamentally transform the current processes to a fossil-free production also there”.

Early action

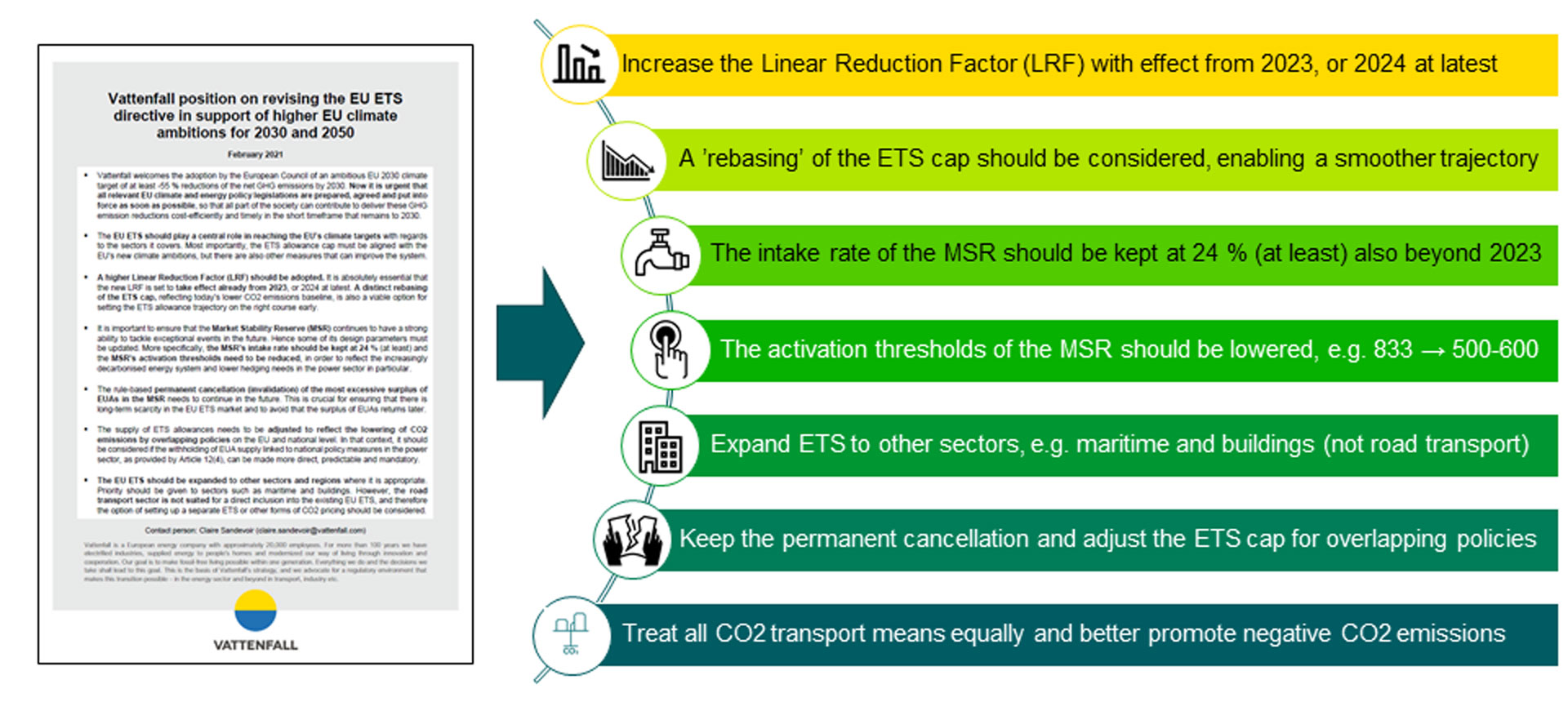

Setting the ETS cap trajectory on track to the EU’s new 2030 and 2050 climate targets have the highest priority in the upcoming reform of the EU ETS directive. Here, the Linear Reduction Factor, LRF (see fact box), will be important in order to limit the number of emissions allowances over time.

"It’s definitely necessary to further increase the Linear Reduction Factor to reach the new targets, but we also emphasise that it must be done as soon as possible," Erik Filipsson explains based on Vattenfall’s new position. "Early action is the key word here. We have only 8,5 years left to achieve the EU’s new target of reducing the CO2 emissions.”

Also, it will probably take at least 1,5 years before the EU negotiations are completed. Vattenfall believes that applying a new Linear Reduction Factor from 2023, or 2024 at latest, is possible and that it would be much better than to have to set a much higher LRF from 2026, because that could be disruptive for many companies and place too much of the reduction effort on the last few years of the present decade.

“Basically, we aim for predictability, a forward-looking and balanced cap trajectory, as well as more early action”.

Group position paper

Vattenfall's new position paper on the upcoming revision of the EU ETS Directive was adopted in February, well ahead of the legislative proposal that is expected to be published by the European Commission this summer. Erik Filipsson and Nanne Visser 't Hooft are both a part of Vattenfall’s Expert Task Force (ETF) on Decarbonisation Policies, that was responsible for preparing the group position.

“Despite the recent successful reforms, it is pressing to swiftly proceed with making the EU policies fully aligned with the new climate ambitions for 2030 and 2050. Setting targets in line with the Paris Agreement is very important, but it is strong policies and corporate actions that can drive real change” says Erik Filipsson.

Vattenfall’s key recommendations for quickly reforming the EU ETS to steer towards increased EU climate ambitions

Vattenfall’s new EU ETS position paper (PDF)

Linear Reduction Factor

A CO2 allowance is the right to emit one tonne of greenhouse gases. The European Commission has set a limit for the total CO2 emissions from activities covered by the EU ETS directive: the target for 2020 was a 21% reduction compared to 2005, with a ceiling of 1.6 billion tonnes of CO2 by 2020. Since 2020, that ceiling has been decreasing by 2.2% each year; we call this the Linear Reduction Factor (LRF). In the coming years, the LRF needs to be increased further to align with the new EU 2030 climate ambition.

Market Stability Reserve

A new mechanism was put in place from 2019, the Market Stability Reserve (MSR) with the purpose of tackling the historical over-supply and cater for a more robust CO2 price development. In case a certain level of market surplus is reached, then each year 24% of the total amount of allowances are taken out of the market and put into a reserve. The most excessive CO2 allowance holdings in the reserve are permanently cancelled, while some are kept to re-enter the market if it becomes too tight. The MSR is currently subject to a review to ensure that it remains fit for new challenges in the future.

Falling emissions

In 2019, emissions from installations in all countries participating in the EU ETS decreased by 9.1% compared to 2018. The decrease was mainly due to the energy sector, where emissions fell by almost 15% as coal was replaced by electricity from renewables and gas-fired power generation. Emissions from industry fell by almost 2%. In 2020, the emissions drop was even sharper (12.6 %), due to a combination of e.g., the COVID-19 crisis, the high EU ETS market prices, and the continued strong deployment of renewable energy capacity.