Vattenfall to sell German lignite operations

Vattenfall has today signed an agreement to sell Vattenfall’s lignite operations to Czech energy company EPH with its financial partner PPF Investments. The divestment represents a major step in Vattenfall’s shift towards more sustainable production. Germany remains a strategic growth market for Vattenfall.

“Today we have signed an important deal for Vattenfall. This divestment of our lignite assets is good strategically but also financially given current and expected market conditions. We are now accelerating our shift towards a more sustainable production. The sale means more than 75 percent of our production will be climate neutral compared to about 50 percent today,” says Magnus Hall, Vattenfall’s President and CEO.

A new owner for the lignite operations

The buyer consists of a consortium of two companies. Czech EPH is an established European energy group, based in Prague, with operations in Western and Central Europe. EPH’s activities are ranging from gas transmission, power and gas distribution, gas storage, heat infrastructure and power and heat generation.

PPF Investments is an international finance and investment group, with focus on Central and Eastern Europe and Asia. “After thorough due diligence we are pleased to have found a well-established new owner for the lignite business with approximately 7,500 skilled and committed employees. EPH has proven expertise in lignite mining and is already present in Germany through its wholly-owned subsidiary MIBRAG,” says Magnus Hall.

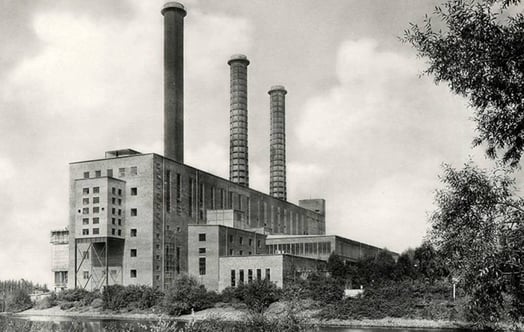

The sale includes all of Vattenfall’s lignite assets in Germany. Those are power plants Jänschwalde, Boxberg, Schwarze Pumpe and Vattenfall’s 50 percent stake in Lippendorf, as well as the open cast mines Jänschwalde, Nochten, Welzow-Süd and Reichwalde and the recently closed mine Cottbus Nord.

Financial settlement – responsible transition

The buyer will take over the lignite business, with all its assets, liabilities and provisions. The assets include cash amounting to a total of 15 billion SEK. The liabilities and provisions, including re-cultivation obligations, amount to a total of 18 billion SEK. No payment of dividends or dissolution of any reserves or similar transactions is possible during the first three years. The two following years the possibility to extract cash from the business is limited by the agreement to profits from normal operations. Hedges that Vattenfall has made to secure the electricity price for the lignite operations will remain in Vattenfall at a value of 9 billion SEK.

The result of the divestment in Vattenfall’s income statement by Q2 2016 will be in the range of minus 22-27 billion SEK. If Vattenfall were to remain the owner, the total negative impact on Vattenfall’s income statement would be higher than if the business is divested with Vattenfall’s present future price expectations.

“We want to reduce our CO2 exposure, so for us this is the right thing to do and it frees up resources to focus more on renewable energy. We see significant risks when it comes to the development of future electricity price levels. There are also regulatory risks to take into consideration,” says Magnus Hall.

The agreement furthermore foresees the continuation of the collective-bargaining- and tariff-agreement for employees as well as the codetermination and representative participation.

An active part in Germany’s ‘Energiewende’

“As an international energy company with the ambition to be one of the leaders in the new energy landscape it is important for us to take an active part in the German ‘Energiewende’. Germany will remain an important market for Vattenfall. It is not only one of the largest energy markets in Europe, but also a frontrunner in the energy transition,” says Magnus Hall.

“We see growth opportunities in being the partner of choice for sustainable solutions for customers and cities. The number of our German customers is growing, today standing at more than 3 million. Starting from Berlin and Hamburg, we are also committed to offer an economically and environmentally attractive development and to further invest in partnerships with German cities,” says Magnus Hall.

By concluding the deal, Vattenfall’s CO2 exposure will be reduced from more than 80 million tonnes to less than 25 million tonnes per year. At the same time it also represents a major step in radically shifting business focus in Germany. The lignite divestment is a major step in Vattenfall’s overall strategy to focus on further developing in wind, district heating, distribution networks and customer-centric energy services.

Time line

The proposed deal was today submitted to Vattenfall’s owner, the Swedish state. The finalization of the deal is expected in a couple of months after the needed confirmation by the owner. The deal will also be subject to relevant regulatory approval.

Vattenfall discloses this information pursuant to the Swedish Securities Market Act.

Issued by Vattenfall’s Press Office, telephone: +46-8-739 50 10, e-mail: press@vattenfall.com.

--------------------------------------------------------------------------

Press conference starting 16.00 CET, 18 April. A separate telephone conference for investors and financial analysts will be held at 19.00 CET, 18 April.

Dial-in information and presentation slides will be available at corporate.vattenfall.com.

The press conference will be hosted by Vattenfall’s chairman of the board Lars G Nordström, president and CEO Magnus Hall and CFO Ingrid Bonde, at Vattenfall’s head office, Evenemangsgatan 13, Solna, Sweden. The presentations will be followed by a Q&A session and individual interviews.

The press conference will be held in English.

The webcast will be broadcasted at Vattenfall Live Webcast 16.00 CET 18 April .

Please allow a few minutes before start.

The telephone conference:

Please allow a few minutes before start.

- +46 (0) 8 505 100 31 (Sweden)

- +44 (0) 203 059 58 62 (UK)

Presentation slides will be available on corporate.vattenfall.com