Operating segment Power Generation

The Power Generation operating segment comprises the Generation and Markets business areas.

Forsmark nuclear power plant.

Business Area Markets maximises the value of Vattenfall’s portofolio by optimising and dispatching, trading, hedging and sourcing for Vattenfall, third-party assets, and sales positions.

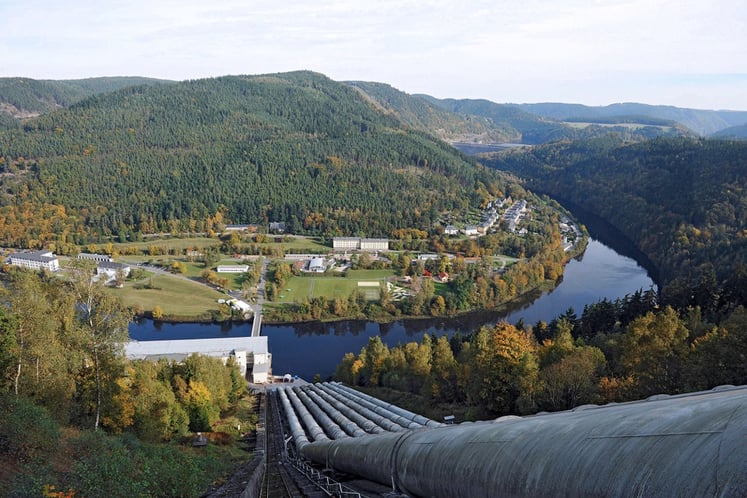

Vattenfall’s total installed hydro power capacity of 8,800 MW generated 34.7 TWh (36.1) of electricity. Business Area Generation produced a total of 72.6 TWh (73.5) of electricity in 2024 in our hydro power plants across the Nordics and in Germany, and our nuclear power plants in Sweden. At year-end, Vattenfall’s Nordic reservoir levels were at 82 per cent (56 per cent), which is 25 per centage points above normal. The combined installed capacity of nuclear power was 5,500 MW and generation totalled to 37.9 TWh (37.4).

Strategy and targets

Vattenfall aims to be a world leader in nuclear and hydro power operations with high safety, sustainability, and cost-efficient fossil-free electricity production. Safe decommissioning of closed nuclear reactors is also a key responsibility.

Business Area Markets strives to increase process automation leveraging AI on secure and robust IT platforms. It drives decarbonisation by expanding fossil-free offerings, including biomethane, fossil-free power, and green hydrogen. To capture value from flexibility in for example our hydro power plants, and leverage our trading potential are key for robust and diversified revenue streams.

More about Power Generation

Related content

We have a strong wind portfolio in combination with large-scale solar and batteries.

Our Distribution business owns and operates electricity grids in Sweden.

Customers & Solutions provides electricity, gas, heat and energy solutions.

See also

Related content

We have a strong wind portfolio in combination with large-scale solar and batteries.

Our Distribution business owns and operates electricity grids in Sweden.

Customers & Solutions provides electricity, gas, heat and energy solutions.